Capital gains tax is an important factor that can affect the profitability of your investments. When you sell an investment, such as stocks, real estate, or mutual funds, for a profit, the government taxes the gain you make. However, there are several strategies you can use to minimize the amount of capital gains tax you owe, ultimately helping you keep more of your hard-earned profits. Understanding how to minimize capital gains tax can significantly improve your overall investment returns. In this article, we’ll explore some of the best strategies for reducing capital gains taxes.

1. Hold Investments for the Long Term

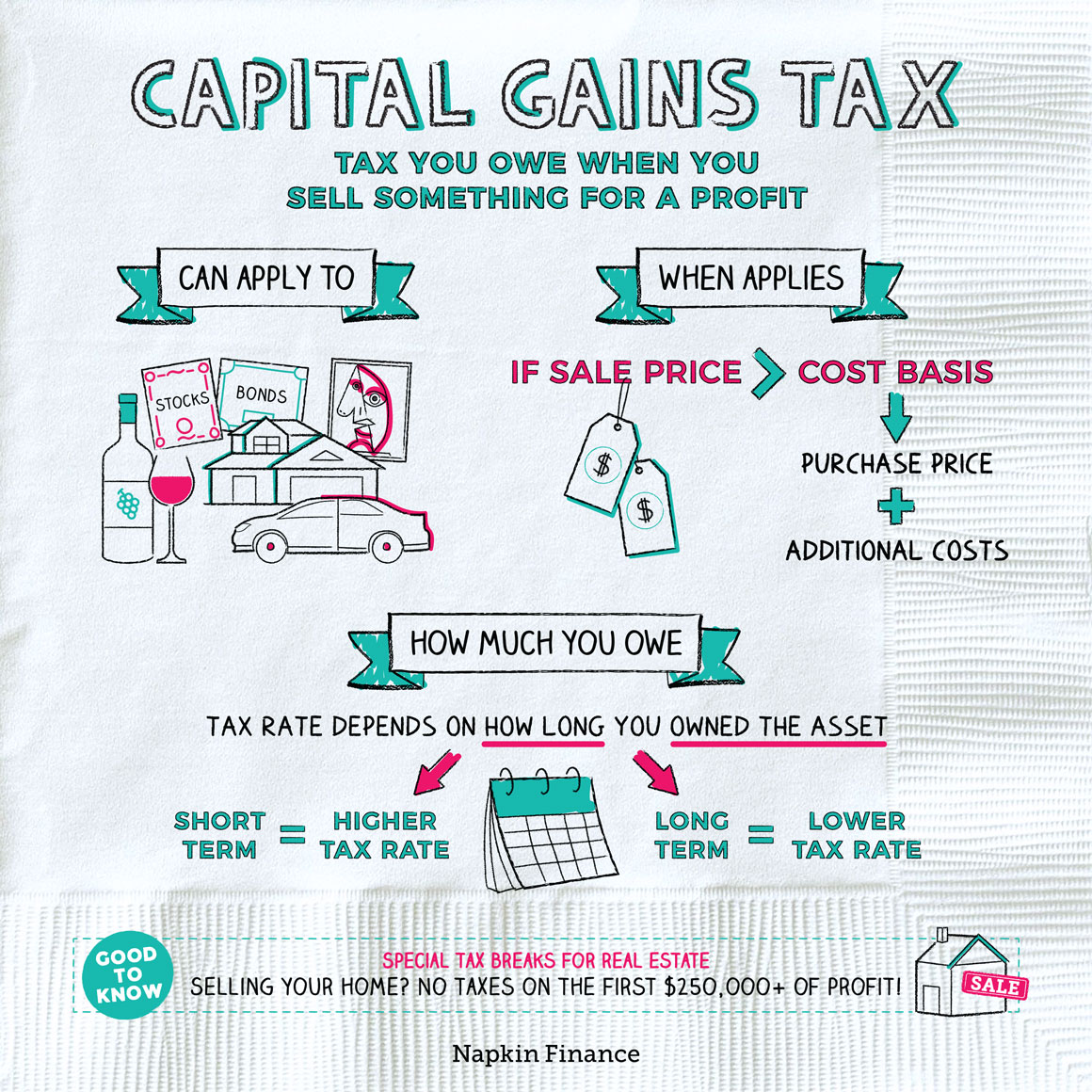

One of the simplest and most effective ways to minimize capital gains tax is by holding your investments for at least one year. The IRS classifies capital gains into two categories: short-term and long-term. Short-term capital gains apply to investments held for one year or less, and these are taxed at your ordinary income tax rate, which can be as high as 37%, depending on your income bracket.

On the other hand, long-term capital gains apply to investments held for more than one year, and they are taxed at a more favorable rate of 0%, 15%, or 20%, depending on your income. By holding your investments for over a year, you can reduce your tax burden significantly, especially for high-income earners. This long-term buy-and-hold strategy not only helps you save on taxes but also provides the opportunity for your investments to grow more over time.

2. Offset Gains with Losses (Tax-Loss Harvesting)

Tax-loss harvesting is another strategy to reduce your taxable capital gains. This technique involves selling investments that have experienced a loss in order to offset the gains you’ve made from other investments. Essentially, you are using your investment losses to lower your tax liability on gains.

For example, if you make a $5,000 gain on one investment and a $3,000 loss on another, you can use the $3,000 loss to offset part of your gain, leaving you with only $2,000 in taxable gains. If your total losses exceed your gains, you can deduct up to $3,000 of the remaining losses from your ordinary income, which can reduce your tax bill even further. Losses beyond $3,000 can be carried forward to future years, allowing you to continue reducing your tax burden in the future.

3. Invest in Tax-Advantaged Accounts

Another excellent way to minimize capital gains tax is by utilizing tax-advantaged accounts. These accounts are designed to reduce or defer taxes on your investment gains. Some common tax-advantaged accounts include:

Individual Retirement Accounts (IRAs): Both Traditional IRAs and Roth IRAs offer significant tax benefits. With a Traditional IRA, you get to deduct contributions from your taxable income, and taxes are deferred until you withdraw the funds. With a Roth IRA, your investments grow tax-free, and qualified withdrawals in retirement are tax-free as well.

401(k) Plans: Like Traditional IRAs, 401(k) contributions are made with pre-tax dollars, and taxes are deferred until you withdraw funds. The investments in your 401(k) grow tax-deferred, helping you to compound wealth without paying taxes on capital gains.

Health Savings Accounts (HSAs): If you have a high-deductible health plan, an HSA allows you to invest tax-free. Contributions to an HSA are tax-deductible, and the money grows tax-free. Additionally, withdrawals used for qualified medical expenses are tax-free, providing you with a triple tax advantage.

By contributing to these accounts, you can either defer or completely avoid paying capital gains tax, allowing your investments to grow more efficiently. This strategy is especially valuable for long-term investors who want to build wealth while minimizing taxes.

4. Take Advantage of the Primary Residence Exclusion

If you sell your primary residence, you may be eligible for a capital gains exclusion. The IRS allows homeowners to exclude up to $250,000 ($500,000 for married couples filing jointly) of capital gains from the sale of their home, provided they meet certain criteria. To qualify, you must have lived in the home as your primary residence for at least two of the last five years before the sale.

For example, if you purchased a home for $300,000 and sell it for $600,000, you can exclude the $300,000 in capital gains from taxation if you meet the residency requirements. This strategy can be particularly beneficial for homeowners who have seen substantial appreciation in their property values. However, it is important to note that this exclusion applies only to the sale of your primary home, not to investment or rental properties.

5. Invest in Tax-Exempt or Tax-Deferred Investments

Certain types of investments can help minimize your capital gains taxes. Municipal bonds, for example, are a type of tax-exempt investment. Interest from municipal bonds is generally exempt from federal taxes, and if you invest in bonds issued by your state, you may also avoid state and local taxes. While municipal bonds don’t directly reduce capital gains taxes, they can lower your overall tax liability, especially for high-income investors.

Another option is tax-deferred annuities. Annuities allow your investments to grow without being taxed until you begin withdrawals, which can be beneficial for deferring capital gains tax until retirement. By using tax-exempt or tax-deferred investments, you can reduce the taxes you pay on your capital gains and other income over time.

6. Gift Appreciated Assets

If you want to minimize capital gains tax while helping family members or charities, gifting appreciated assets can be a useful strategy. You can gift investments, such as stocks or real estate, to family members in lower tax brackets, effectively shifting the capital gains tax liability to them. This strategy works well if the recipient is in a lower tax bracket than you, reducing the overall tax burden.

Additionally, gifting appreciated assets to charity can allow you to avoid capital gains taxes altogether. When you donate appreciated stocks or real estate to a qualified charity, you don’t have to pay capital gains tax on the appreciated value, and you can potentially claim a charitable deduction on your tax return.

7. Use a 1031 Exchange for Real Estate

For real estate investors, a 1031 exchange offers a powerful way to defer capital gains taxes on the sale of a property. With a 1031 exchange, you can sell an investment property and reinvest the proceeds into another “like-kind” property, thereby deferring taxes on the capital gains. This strategy is especially valuable for real estate investors looking to grow their portfolios over time.

To qualify for a 1031 exchange, the property must be used for investment or business purposes (not a primary residence), and there are strict timelines and rules that must be followed. The property you buy must be of equal or greater value than the one you sell. While a 1031 exchange allows you to defer taxes, it doesn’t eliminate them, and you will owe taxes when you eventually sell the replacement property.

Conclusion

Capital gains taxes can eat into your investment returns, but there are several strategies available to minimize your tax burden. By holding investments for the long term, utilizing tax-loss harvesting, taking advantage of tax-advantaged accounts, and employing strategies like gifting appreciated assets or using a 1031 exchange, you can reduce the amount you owe in capital gains taxes. As always, it’s essential to consult with a tax professional or financial advisor to ensure that you are utilizing the right strategies for your individual situation and complying with all tax regulations. By carefully planning your investment strategy, you can retain more of your profits and build wealth more effectively.